Credit Builder Loans: A Complete GuideBoosting Your Credit and Savings

Discover how these unique loans can help you establish or repair your credit history while building savings.

Building credit from scratch or repairing a poor credit score can feel daunting. If you’re a U.S. resident with little or no credit history, you’re not alone – some 28 million Americans have no credit score (often called “credit invisible”) and 21 million have too little credit data to be scored. Without a solid credit profile, things like getting a credit card, an auto loan, or even an apartment lease can be challenging. This is where credit builder loans come in. These special loans are designed to help you establish credit history and even save money in the process.

In this comprehensive guide, we’ll explain what credit builder loans are and how they work, how they impact your FICO® and VantageScore® credit scores, and how they compare to other tools like secured credit cards. We’ll also provide step-by-step guidance on choosing and using a credit builder loan effectively, share expert tips and quotes, and compare leading U.S. credit builder loan providers (like Self, CreditStrong, MoneyLion, etc.) with a handy comparison table. A sample cost breakdown and a brief FAQ are included to answer common questions. By the end, you’ll have a clear roadmap to start building your credit confidently. Let’s dive in!

What Is a Credit Builder Loan?

A credit builder loan is a small installment loan specifically designed to help people build or rebuild credit. It’s sometimes called a “fresh start” or “starting over” loan. Unlike a traditional loan, you don’t get the money upfront. Instead, the lender holds the loan amount in a secure account (often a savings account or certificate of deposit) while you make fixed monthly payments. Once you’ve paid off the loan in full, you get back the money (minus any interest and fees). Essentially, it’s a forced savings plan that reports to the credit bureaus.

In other words, a credit builder loan works in reverse of a normal loan: you pay first, and receive the funds later. Each payment is reported to the major credit bureaus – Experian, Equifax, and TransUnion – helping you establish a record of on-time payments. Because the lender is holding the money (reducing their risk), these loans are accessible to people with no credit or poor credit; approval is usually easy as long as you have income to make payments.

Key features of credit builder loans:

- Small loan amounts: Typically around $300 to $1,000 (though some offer more).

- Short terms: Usually 6 to 24 months for repayment. You choose a term with payments that fit your budget.

- No immediate funds: The loan amount is locked in a bank account until you finish paying. This means you won’t have access to the cash until the term ends.

- Reported to credit bureaus: The main purpose is to build credit, so lenders report your payment history monthly. Consistent on-time payments will gradually build your credit history and score. (Missing payments, however, will hurt your credit – more on that later.)

- Interest and fees: You pay interest on the loan (rates vary by lender), and some lenders charge small administrative or origination fees (for example, $9–$15 is common). We’ll provide a cost example below. The good news: at the end of the loan, you’ll have a sum of money (your paid-off loan) which can jump-start an emergency fund or go toward another goal.

Who are credit builder loans for? They are ideal for credit “newbies” or rebuilders – if you have no credit history, a thin credit file, or a bad credit past, this tool gives you a second chance. It’s also useful for young adults or recent immigrants who need to establish credit. In fact, credit builder loans can help people who are “credit invisible” get on the scoring radar. However, if you already have some credit (e.g. a credit card or other loan), the boost from a credit builder loan may be smaller. And if you need cash immediately, this isn’t the right choice, since you won’t get the funds until you’ve made all the payments.

How Do Credit Builder Loans Work?

Step-by-step, here’s how a typical credit builder loan works:

- Apply and get approved: You choose a lender (examples in the comparison table below) and apply for a credit builder loan. No credit score is required – many lenders approve everyone who meets basic criteria (identity verification, steady income, etc.). Often there’s no hard credit inquiry for these loans, so applying won’t ding your score. Tip: Still, ensure the lender reports to all 3 credit bureaus (not all do, but most major ones like Self, CreditStrong, etc. report to all three). This maximizes the credit-building effect.

- Loan funds are held in an account: If approved, the lender doesn’t give you cash in hand. Instead, they deposit the loan amount into a secure account in your name (often a savings account or CD). Think of it as locked savings. For example, if you take a $500 credit builder loan, that $500 is set aside by the bank.

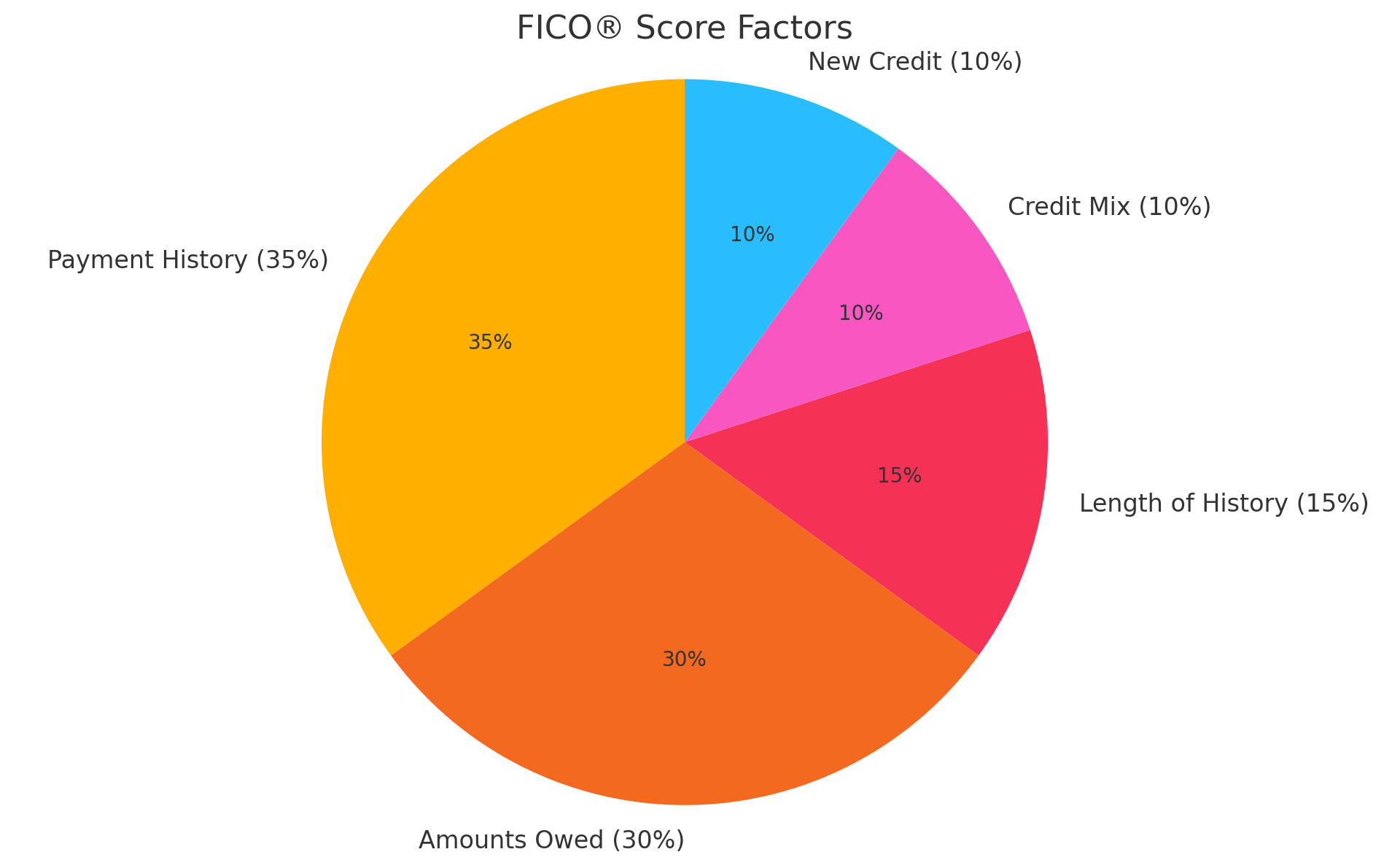

- Make monthly payments: You agree to make fixed monthly payments for a set term (say $50 a month for 12 months, in the case of a $600/12mo loan). Each payment includes principal and interest, similar to a regular installment loan. Because the loan is secured by the funds, lenders can offer predictable, fixed payments that are easier to budget for. It’s critical to pay on time, every time. Setting up autopay can help – as Experian notes, “Payment history is the most important factor in your credit scores” (35% of a FICO score). Missing even one payment can hurt your credit, so treat this like a real obligation (because it is!).

- Credit bureaus get your payment info: The lender reports your payment activity to the credit bureaus each month. With every on-time payment, you’re building a positive credit history. Over the course of the loan, you’re proving you can responsibly handle debt. (If you pay late, that will also be reported, which can damage your score – so avoid late payments at all costs. Many lenders have a small grace period, e.g. 14 days, but don’t rely on it. On-time means on or before the due date.)

- Loan completion – get your money back: After you make the final payment, the loan is fully repaid. Now the lender unlocks the account and releases the funds to you. You’ll receive the original loan amount (plus any interest your savings accrued, if applicable) minus any fees or unpaid interest. For example, at the end of a $600 loan, you get roughly $600 back (the principal you paid in), and you’ve built some credit history. Some lenders even return a bit of interest to you: credit unions, for instance, often put the funds in an interest-bearing account, so you earn small “dividends” that can offset part of the cost.

- Result: You now have savings in hand (which you could use as an emergency fund or to secure a credit card) and, if all payments were on time, you’ve likely improved your credit score. At this point, you’ll have an installment loan on your credit report marked “paid as agreed” – a positive sign to future lenders.

It’s worth noting that the longer your loan term, the more interest you’ll pay overall (since you’re making payments for a longer period). However, longer terms mean smaller monthly payments, which might fit your budget better. Choose a term that balances affordability and total cost. The primary goal is building credit, so you don’t want to overstretch and risk missing payments. Always pick a monthly payment you can comfortably afford.

Example: What a $600 Credit Builder Loan Costs

To make this concrete, let’s look at an example cost breakdown. Suppose you take a $600 credit builder loan with a 12-month term at around 12% APR (annual percentage rate). Here’s what it might look like:

- Loan principal: $600 (held in savings by the lender during the 12-month term)

- Monthly payment: Approximately $53 per month for 12 months (this includes principal + interest).

- Total paid over 12 months: ~$636 ($53 × 12) – this is the $600 you paid in, plus about $36 in interest.

- Interest paid: ~$36 (the cost of borrowing your own money in this case).

- One-time fee: Let’s say there’s a small administrative fee of $9 to start the loan (common with some providers like Self).

- Total out-of-pocket cost: $36 interest + $9 fee = $45 (roughly). This is the “price” you paid to build credit and save $600.

- Cash you get at the end: $600 (your original loan amount is returned to you; you can now use it as needed).

In this scenario, you spent about $45 over the year for the opportunity to build credit history. In exchange, you now have $600 in the bank (which you might not have saved otherwise) and a string of positive payments on your credit report. Many find this trade-off worth it. (Your actual costs will vary based on the lender’s interest rate and fees – some credit builder loans have lower rates, and one even has no fees/0% APR as we’ll see below.)

How Credit Builder Loans Affect Your Credit Score

The whole point of a credit builder loan is to improve your credit, so let’s talk about exactly how that happens. Both FICO® Scores and VantageScore credit scores consider your credit builder loan, but they weight things a little differently. The good news is that consistently paying a credit builder loan on time can benefit both scoring models.

Here are the key ways a credit builder loan impacts your credit:

- Payment History: This is the #1 factor in most credit scores (35% of a FICO score). Every on-time payment you make adds a positive mark to your history. Over 6–24 months, you could accumulate a dozen or more on-time payments, which significantly boosts your credit profile. Timely payments on a credit-builder loan could help you qualify for better rates on other credit products in the future. Bottom line: Make ALL payments on time. Even one late payment (30+ days past due) can set you back by hurting your score and defeating the purpose of the loan.

- Credit Mix: Credit scoring models like to see that you can handle different types of credit (this factor accounts for ~10% of your FICO score). A credit builder loan is an installment loan (fixed payments for a set term), which is a different type of credit than, say, a credit card (which is revolving credit). If you only have credit cards on your report, adding an installment loan diversifies your credit mix, which can give your score a small boost. Conversely, if you only had loans, adding a credit card would help mix; the idea is a blend can be beneficial. Note: Don’t worry about this factor until you’ve handled payment history – mix is a smaller piece of the puzzle.

- Length of Credit History: When you open a new credit builder loan, it will appear as a new account on your credit report. If you’re brand new to credit, this actually gives you a credit history where you had none. (FICO requires at least 6 months of history to calculate a score, so a 6- or 12-month credit builder loan can help you achieve a score if you had zero before.) Over time, keeping accounts open longer helps your "average age of accounts" and overall credit history length. A credit builder loan is a great first account to get your history started. Just be aware that initially, since it’s new credit, your average age of accounts is low – but that’s true of anyone just starting out.

- New Credit/Inquiries: Most credit builder loans do not require a hard credit inquiry, which is good because it means you won’t lose a few points from a hard pull. (Many providers use a “soft pull” or no pull at all for these low-risk loans.) If a lender does do a hard pull, the impact is usually small and temporary (new inquiries ~10% of score). Additionally, the new account itself may cause a slight initial dip in your score until you establish a payment history. Don’t be alarmed if your score drops a few points when the loan first appears – this is normal and should be offset as positive payments accumulate.

- Amounts Owed (Utilization): For revolving credit (credit cards), the balance-to-limit ratio (“credit utilization”) is crucial. For installment loans like a credit builder loan, utilization is less of a factor, but having a high balance relative to the original loan amount can mildly affect your score. In the beginning, your loan balance is equal to the original amount (e.g. you owe the full $600 on a $600 loan). As you make payments, your balance decreases. Paying down an installment loan over time is seen as positive, though this factor is much smaller than credit card utilization for scoring. One unique case: CreditStrong offers a revolving credit product (line of credit) that doesn’t allow draws, purely to boost available credit and lower utilization. But generally, focus on the big picture: pay on time, and by the end of the loan you’ll have a fully paid account which is a plus.

How much can a credit builder loan raise your score? Results vary per person. If you were “invisible” (no score) or had only negative history, you could see a significant jump. For instance, after a year of on-time payments, it’s possible to go from no credit to a score in the high 600s or even 700s. According to credit expert Barry Paperno (who worked at FICO and Experian), “Regardless of the loan amount, one year of on-time-payment installment loan history with no other credit on the report should deliver a decent score.” In fact, Paperno notes that these loans have helped people build scores in the high-600s or low-700s range. Of course, if you already had some credit accounts, the improvement might be more modest. The key is that you’re adding positive history; every situation is unique.

Credit Builder Loans vs. Secured Credit Cards

Two of the most popular tools for building credit are credit builder loans and secured credit cards. They both can help someone with poor or no credit establish a positive record. But they work very differently. Let’s compare these options and see when one might be better than the other:

- Upfront Deposit vs. Gradual Payments: A secured credit card requires an upfront security deposit (typically $200 – $300 or more). That deposit becomes your credit line. For example, you give the bank $300, and you get a card with a $300 limit. In contrast, a credit builder loan usually doesn’t require any money upfront (beyond a small fee). Instead, you commit to paying, say, $50 a month. If you don’t have a lump sum to put down right now, a credit builder loan might be easier to start (“if you can’t provide a security deposit, you might be able to qualify for a credit-builder loan”).

- Access to Funds: With a secured card, you can start using the card immediately for purchases (up to your limit). You have access to credit (your own deposit, essentially) and can buy gas, groceries, etc., then pay the card bill. With a builder loan, you cannot access the funds until you’ve finished paying off the loan. It’s purely for building credit and savings – you won’t be able to use that locked money until the term ends. This is a crucial difference: if you need a credit line for emergencies or everyday use, a secured card offers that, while a builder loan does not.

- Ongoing Use vs. One-and-Done: A secured credit card is revolving credit – you can use it, pay it down, and use it again indefinitely. It can be kept open for years (and often that’s beneficial for building long credit history). A credit builder loan is an installment account with a fixed end date – once you’ve made all the payments and got your money, the account is closed (unless you take another loan). So a card can continue to help you build credit long-term and may even be converted to an unsecured card later. A builder loan is more of a temporary credit-building exercise.

- Cost: Credit builder loans charge interest (and sometimes a fee), but you get most of your money back at the end. Essentially, the net cost is the interest/fees paid. Secured credit cards may charge an annual fee, and if you carry a balance, you’ll pay interest on purchases. However, you can avoid interest on a credit card by paying the full statement balance each month. So, a secured card could potentially cost very little (just the opportunity cost of your deposit and any annual fee) if used wisely. In contrast, a credit builder loan’s interest is unavoidable as part of the program. Some credit builder loans have pretty high APRs (10-15% is common; some up to ~16% APR, and MoneyLion’s product can go nearly 30%), while secured cards often have high APRs too (20%+), but again, you don’t pay that if you don’t revolve a balance.

- Credit score factors: Both will help payment history if you pay on time. A secured card affects your credit utilization ratio (keep balances low, ideally under 30% of your limit or less, to help your score). A builder loan doesn’t directly impact revolving utilization, but it adds an installment trade line to your report. Having both an installment loan and a revolving account can maximize your credit mix. As Experian’s credit experts explain, “Credit scores reward you for responsibly managing more than one kind of credit”. So, one strategy is to use a credit builder loan first, then once your score improves, get a secured or low-limit credit card. Personal finance expert Liz Weston (CFP) suggests this modern approach: “Start with a credit builder loan, then add a credit card to the mix”. This way you build credit and savings with the loan, then continue to build credit (and now have a usable card) thereafter.

- Ease of approval: Both are designed for people with poor/no credit. Secured cards usually don’t check credit too strictly (since you’re securing the line with a deposit), though some do a credit pull. Credit builder loans generally have very lenient approval – as long as you have income and no recent bankruptcies, you’re in. If your credit is really bad (e.g. recent defaults), some secured card issuers might reject you, whereas many credit builder lenders say “everyone is approved” (because the lender’s risk is minimal). So if you’ve been denied even a secured card, a credit builder loan could be the fallback to get some positive history going.

Which is better? It doesn’t have to be either/or – you can do both (sequentially or even at the same time) if you can manage them responsibly. But if you must choose one:

- Choose a credit builder loan if you don’t have a lump sum for a card deposit, or if you worry you might overspend with a credit card. The loan forces you to save and has a clear end. It’s a set-and-forget installment payment that builds credit without the temptation to rack up debt (since you can’t touch the money). It’s also a good choice if your primary goal is credit history rather than needing a card for transactions.

- Choose a secured credit card if you need access to credit for purchases (or online transactions, travel, etc.), and you have the self-discipline to use it sparingly and pay on time. A card can also be kept open to continue building credit beyond one year. Just remember to keep the balance low and pay in full monthly to avoid interest. Also, you’ll need to tie up some cash as the deposit for a while.

Many financial counselors actually recommend doing both (one after the other). For example, you might do a 12-month credit builder loan now; after 6 months, your new credit score could qualify you for a decent secured credit card or even an entry-level unsecured card. Then you use the card responsibly alongside finishing your loan. By the end of the year, you’ve got a paid-off loan and an active credit card – and a much stronger credit profile. Tip: Some programs integrate the two: e.g., Self offers a secured credit card that you can get after making 3 months of payments on their credit builder loan, using your accumulated savings as the deposit. This kind of combo can accelerate your credit-building.

Comparing Top Credit Builder Loan Providers (U.S.)

There are many banks, credit unions, and fintech companies that offer credit builder loans. Below, we compare some leading U.S. credit builder loan providers and their key terms, fees, credit reporting practices, and unique features. This will give you a sense of what’s available in 2025 and how they differ:

| Provider | Loan Amount & Term | Costs (APR & Fees) | Credit Reporting | Unique Features |

|---|---|---|---|---|

| Self (Credit Builder Account) | Four plan options – pay $25, $35, $48, or $150 per month for 24 months (approx. $600–$3,600 total saved). 12-month term also available in some cases (e.g. ~$520 loan over 12 months). | APR ~15% (15.5%–15.9% APR typical). One-time $9 admin fee to open. No monthly service fee (just interest). Late fee up to 5% of payment. | Reports to all 3 bureaus (Equifax, Experian, TransUnion). Reporting is monthly. | Widely available nationwide (50 states). Very user-friendly mobile app. Offers a secured credit card option – after 3 on-time payments and $100 saved, you can unlock the Self Visa® card to further build credit. Note: $0 annual fee first year, then $25/year for the card. |

| CreditStrong (Austin Capital Bank) | $1,000 – $10,000 loan amounts (one of the highest limits). Term: 24 to 60 months (2 to 5 years). Multiple plan options (e.g. “Instal” loans for building personal credit, and “CS Max” for larger amounts/business credit). | APR ~7%–15% (rates vary by plan; 6.99%–15.73% APR). Origination fee: $15 for regular Install loans, $25 for large CS Max loans. No monthly fees (except the interest). No prepayment penalty. If using the Revolv revolving account, there’s a $99/year subscription fee instead of interest (this provides a $1,000 line of credit for credit utilization purposes). | Reports to all 3 bureaus on all products. (Instal loans build payment history; Revolv line builds available credit on reports.) | Not available in VT or WI (due to state restrictions). Offers both installment and revolving credit-building products. The Revolv option is unique: you don’t make monthly payments on it, but it adds a $1,000 unused credit line on your reports to help lower your credit utilization. Flexible plans – you can choose a low payment (as little as ~$28/mo) for a longer term to build savings gradually. |

| MoneyLion (“Credit Builder Plus” membership) | Up to $1,000 loan. Term: 12 months (1 year) typical. (Loans are relatively short-term and smaller.) | APR: High – up to 29.99% APR. Also requires a membership fee of $19.99 per month to use the Credit Builder program. However, part of that fee also gives access to other MoneyLion services (like cash advances, financial tracking app, etc.). No separate origination fee, but the membership fee is essentially a cost. | Reports to all 3 bureaus. (Make sure to remain a member in good standing so reporting continues throughout the loan term.) | Immediate access to a portion of funds: Unlike most credit builder loans, MoneyLion lets you access some of the loan money right away. (E.g., you might get ~25% of the loan upfront, while the rest is held to the end – this portion can help if you need cash now, but you’ll still repay the full loan.) Comes as part of a broader fintech app (mobile banking, investing, etc.). Note: MoneyLion has a pending CFPB action (consumer watchdog investigation) for allegedly excessive fees – so be aware of that controversy. This option is relatively expensive due to the monthly fee + high APR, so consider if the extra services and partial upfront cash are worth it for you. |

| Credit Karma (SeedFi Credit Builder) | $500 – $1,000 credit building plan. No fixed term – it’s an ongoing program until you reach your savings goal (at least $500). You contribute a flexible amount each month (minimum $10) from a provided line of credit into a locked savings. Once you’ve saved $500, those funds are released to you and the cycle can repeat up to $1,000. | 0% APR – completely free. No interest, no fees. (Credit Karma’s program essentially gives you a free credit-builder line of credit; they likely make money on the deposit’s interest or by keeping you engaged with their app.) No admin or origination fees. | Reports to all 3 bureaus (via the line of credit that SeedFi/Intuit manages – as you “borrow” and repay each month, it reports like a revolving account). | Completely free credit builder. This is a unique program by Credit Karma (in partnership with SeedFi/Intuit). It’s effectively a credit-builder savings plan with a free line of credit. You transfer at least $10 from the provided credit line into a savings account each month, then pay off that small credit line balance. These repeated small “borrow and repay” actions get reported, building your credit. When your saved amount hits $500, it’s unlocked to your Credit Karma spending account (which you’ll need to open). As you save more, your credit line limit can increase up to $1,000. The beauty is no cost at all – a great option if you’re already using Credit Karma. Just note you must manage a Credit Karma Money account and ensure you make those transfers and payments monthly. |

| DCU (Digital Federal Credit Union) (Example Credit Union) | $500 – $3,000 loan amounts. Term: 12 to 24 months. (You choose within that range.) | APR: 5.00% fixed – one of the lowest rates in the nation for credit builder loans. No fees (no admin or origination fee). In fact, your loan funds earn a small amount of interest/dividends while held in your savings (which helps offset the 5% you’re paying). | Reports to all 3 bureaus (as is typical for credit unions, though DCU’s documentation specifically notes it as a credit-building loan). | Low cost, but membership required. DCU is a credit union, so you must become a member to get the loan. Membership is open via certain communities, employers, or by joining a partner organization (often you can join a charity for ~$10 to qualify). Available nationwide with easy membership routes. Funds are held in a DCU savings that earns interest during the term. Be mindful that some users report DCU’s customer service is slow, but it remains a popular choice for its low rates. Consider local credit unions near you as well – many offer similar credit builder loans (sometimes called “Savings Secured Loans” or “Fresh Start Loans”) often with low rates. |

Sources: Provider websites and disclosures, Investopedia, Business Insider, Money.com, Credit Karma, and DCU documentation. (All information is up-to-date as of early 2025, but terms may change – always check with the provider for the latest details.)

As you can see, credit builder loans share the same basic idea but can vary in specifics. For instance, Self is great for its accessibility and the option to transition into a secured credit card (so you get a two-in-one credit-building strategy). CreditStrong stands out for offering large loan amounts and even a credit-building line of credit for those who want to supercharge their credit utilization ratio. MoneyLion provides some upfront cash (useful if you need a bit of money now) but at a high cost, making it a pricier route. Credit Karma’s/SeedFi’s program is an excellent no-cost option if you’re comfortable using an app-based service and don’t mind not having a traditional “loan” per se. And credit unions like DCU show that if you’re willing to join, you can get very low rates – potentially making the cost of building credit extremely cheap.

Tip: When comparing providers, pay attention to: interest rates/APR, any fees, the monthly payment amount required, whether there’s a credit check, and if they report to all three bureaus. Also consider any extra perks (like Self’s card or CreditStrong’s unique products) that align with your goals. For many users, availability is key – not all providers operate in every state (e.g., CreditStrong skips a couple states, some credit unions are regional). The five listed above are available broadly in the U.S. (with noted exceptions).

How to Choose and Use a Credit Builder Loan Effectively

Ready to start building credit? Here’s a step-by-step guide to choosing the right credit builder loan, getting approved, and making the most of it. Following these steps will ensure you maximize the benefit to your credit score while avoiding pitfalls.

- Assess your budget and goal: Start by deciding how much you can afford to pay each month. Look at your income and expenses – what payment amount could you comfortably handle without strain? Remember, the goal is to make every payment on time, so choose a realistic amount. If you can only spare, say, $25 a month, that’s fine – there are loans for that. Also consider your goal amount to save. Many credit builder loans will return roughly what you pay in (minus costs), so think about how much you’d like to have in savings at the end (e.g. ~$500, $1000, etc.). This will help narrow your choices.

- Shop around for lenders: Research various credit builder loan providers – including online fintechs, local banks, and credit unions. If you belong to a credit union, see if they offer a credit builder program (many do, often with lower rates). Online options like Self, CreditStrong, etc., are convenient and available nationwide. Compare key factors: interest rates/APR, any upfront fees, the available loan amounts/terms, and special features. For example, some have 0% APR (Credit Karma), some have low APR (credit unions), some might give part of the money early (MoneyLion). Ensure any lender on your shortlist reports to all 3 credit bureaus – this is crucial, as reporting to only one or two bureaus will limit the boost to your overall credit profile.

- Check eligibility and requirements: Review the application requirements for the lenders you like. Generally, you must be 18+ years old, a U.S. resident, and have a valid SSN or ITIN. Most don’t require a minimum credit score (since they cater to credit-building). However, some have other criteria: for example, you might need to be a member of a certain credit union, or reside in a state they operate in (remember to verify state availability). Also, prepare the basic info you’ll need to apply: government ID, proof of address, and perhaps proof of income or employment. Many applications will ask for your monthly income to ensure you can make payments. The process is usually pretty straightforward and often online.

- Apply (soft pull if possible): Fill out the application with accurate information. Most online lenders will do an identity check and possibly a soft credit pull (which doesn’t affect your score). In rare cases, a lender might do a hard pull or have an internal review – if you’re worried, you can check the FAQ or ask the lender if they do a hard inquiry for a credit builder loan. Since these loans are low risk for lenders, approval rates are high – as long as you provide the needed info, you’re likely to be approved even with no credit or bad credit. If for some reason you are denied, don’t panic – find out why (perhaps an identity verification issue or something), address it, and try another lender. There are many options, so one denial isn’t the end.

- Understand the terms before finalizing: Before you sign or agree, read through the loan terms and conditions. Note the payment amount, the due date each month, and how long you’ll be paying. Look for any fees: Is there an origination or admin fee? Any monthly service charge? Most importantly, know the interest rate and calculate roughly what the total cost will be (some lenders show you the total dollar cost upfront). Also check the policy on early payoff – virtually all will allow it (you could close the loan early if you wanted), but some might not refund certain fees if you do. (Generally, you’re free to pay it off early, but keep in mind that stopping early means fewer months of payment history reported – it might be better to keep it open for at least 6+ months for credit-building purposes.) If anything is unclear, ask questions or find answers in their FAQs. It’s important you’re comfortable with the commitment you’re making.

- Make payments on time (set it and forget it): Once approved, you’ll start making your monthly payments. Setup automatic payments (autopay) from your bank account if possible. This way you won’t forget a payment. Since the amount is fixed, you can budget for it easily. Treat this payment like a small subscription or bill that MUST be paid. If an emergency comes up and you think you might be late, communicate with your lender – some have grace periods or can work with you if you inform them. But ideally, never miss a payment. Pro tip: Schedule your autopay for a couple of days before the due date, so if it fails for some reason (e.g., bank issue), you have time to manually fix it. Remember, payment history is the whole game here.

- Monitor your credit progress: As the months go by, keep an eye on your credit score and reports. You can use free services (Credit Karma, Experian, etc.) to track your score monthly. Usually, you might see a score appear after ~2–3 months if you had no score before (VantageScore can generate sooner, FICO after ~6 months of history). If you already had a score, you may start seeing gradual improvements after a few on-time payments are reported. It can be motivating to watch your score climb as you demonstrate good behavior. Additionally, ensure that the loan is showing up on your credit reports correctly – you should see a new account with the balance and your payments marked “OK” each month. It’s rare, but if you find the lender isn’t reporting, or something is off, contact them.

- Plan for the end of the loan: As you approach the final payment, plan how you’ll use the money that comes back. Perhaps set that $500 or $1000 aside as an emergency fund (so you don’t undo your progress by missing payments on other bills due to unexpected expenses). Or consider using it to get a secured credit card deposit to continue building credit with a revolving account (you could even use the same money you get back). Many people finish a credit builder loan and graduate to a regular credit card or a car loan if needed, now that their score is higher. Also, be prepared for a slight score change when the loan closes – closing an installment account can’t be avoided; sometimes your score might dip very slightly due to the account no longer being active. Don’t worry – as long as it was paid in full, it will remain on your credit report as positive history for years. At this stage, you should have a much stronger credit profile than when you started.

By following these steps, you’ll set yourself up for success. To summarize: choose a loan you can afford, commit to the full program, and pay on time without fail. It’s a pretty straightforward path to build credit. Many folks even say it was painless – they treated the payment like a “bill” and at the end were pleasantly surprised with a chunk of savings and a higher credit score.

Real-world tip: If you’re unsure which loan to pick, start with one that has low/no fees and a shorter term (like 12 months). That way you’re not locked in too long and you won’t pay much interest. After 6-12 months, you can reassess your credit-building strategy. Also, read reviews or expert commentary. For example, NerdWallet, Bankrate, and others have reviews of these services – use those to gauge customer experiences. Some providers (like certain fintech apps) might have complaints about customer service or confusing policies, so it’s good to be informed. The ones we listed in the table above are among the most reputable and transparent in this space.

Ready to Build Your Credit?

Take the first step today: A credit builder loan can be the cornerstone of your credit journey. Consider the options, pick the one that fits your needs, and get started on improving your financial future. You deserve the opportunities that come with a better credit score – from easier apartment approvals to lower interest rates on car loans. Don’t let a lack of credit history hold you back. Start building your credit and saving money now!

(Insert your preferred credit builder loan provider link or sign-up call-to-action here.)

FAQ: Frequently Asked Questions

Q: Can a credit builder loan hurt my credit in any way?

A: It’s designed to help your credit, but it can hurt if you don’t make payments on time. A late payment (30+ days past due) will be reported as a derogatory mark and can significantly lower your score – just like with any loan. Also, when you first take the loan, a new account might cause a slight temporary dip in your score, and possibly a small hit from a credit inquiry (if the lender does a hard pull). But these effects are usually minor and short-lived. As long as you pay on time and complete the program, the net result should be positive for your credit. One study by Experian noted that “timely payments on a credit-builder loan” can improve your score and help you qualify for better rates down the line. So, the only real “harm” comes from misusing the loan (missing payments or quitting early without a good reason).

Q: Do I get the money from a credit builder loan immediately?

A: No – that’s a key difference from a normal loan. With a credit builder loan, you only get the money after you’ve fully paid off the loan. The funds are held in a secure account during the loan term. It’s essentially forcing you to save. Think of it like this: you’re paying yourself, and the lender is just holding the cash until you’ve proven you can make all the payments. The upside is you have a tidy sum waiting for you later. The downside is if you needed cash now, this loan won’t provide that. (One exception: MoneyLion gives a portion immediately, but then you’re paying fees and interest on it, which not all users find worthwhile.)

Q: What happens if I need to stop or pay off the loan early?

A: Most lenders allow you to pay off the credit builder loan early and unlock your money sooner – there’s usually no prepayment penalty. If you decide to do this, you’ll get your saved money back (minus any interest that accrued up to that point and fees). However, consider the trade-off: once you close the loan, you stop building credit via that account. If you’ve made less than 6 months of payments, you might not have gotten the full benefit to your credit score yet. If possible, try to stick it out for at least 6-12 months of on-time payments before closing, because credit scores typically improve over time with longer payment history. But if an emergency demands it, you can usually get your funds by closing the loan early. Just contact the lender; they will give you instructions and you’ll receive the balance (some might mail a check or transfer to your bank).

Q: Is it better to get a credit builder loan from a bank, credit union, or online fintech?

A: It depends on what you value. Credit unions and some community banks often have the lowest interest rates (as low as 5% in the DCU example) and may even pay you interest on the held funds. That means the cost of the loan is very low. However, you might have to become a member or go through a slightly slower application process. Online fintech lenders (like Self, CreditStrong) are super convenient – easy online signup, slick apps, and available to almost anyone nationwide. Their rates might be higher (often around 12-15% APR), but they’re still affordable for most and they specialize in credit building. They also might offer extras (Self’s credit card, CreditStrong’s line of credit, etc.). Large traditional banks generally do not offer credit builder loans (they prefer secured credit cards as their tool for thin credit customers – one exception noted was BMO Harris bank’s program). So your choice is likely between a credit union or an online specialist. If you want the lowest cost and don’t mind a bit of paperwork, check local credit unions. If you want speed and simplicity, the online services are great. Either way, make sure whichever lender you choose is reputable. All the ones listed in our comparison are legitimate and widely used.

Q: How fast will my credit score go up?

A: This varies, but many people report seeing a credit score established or improved within 3 to 6 months of starting a credit builder loan. Some lenders claim you can get on the credit radar in as little as a few weeks – for instance, Credit Karma’s Credit Builder says you might boost your score in “as few as three days” (that likely refers to VantageScore once a new account is reported). In general, expect it to be a gradual climb, not an overnight jump. The first on-time payment that gets reported could give a nice initial bump (especially if you had zero credit before – going from no score to some score can be quick). But the significant improvements often happen after around 6 months of consistent payments, which is a key threshold for FICO scoring. By the time you finish a 12-month loan, you should see substantial progress – possibly hundreds of points gain if you started from scratch and did everything right. Just remember, credit scoring is complex; if you have other accounts (or negative items from the past), those will also affect how fast and how much your score goes up. The loan is not a magic cure-all; it’s a foundational tool to add positive data.

Q: What if I have bad credit (from past missed payments) – will a credit builder loan fix that?

A: It can help, but it’s not a quick fix for major credit problems. A credit builder loan will add positive new history, which can gradually dilute the impact of older negatives. For example, if you have some late payments or collections from a year ago, adding a year of on-time payments via a credit builder loan will definitely improve your overall credit profile. However, the negative marks will still be on your report until they age off (usually 7 years for delinquencies). Lenders will see both the good new data and the bad old data. Over time, as the negatives get older and you keep building positive history, your score will improve. But if your credit is poor due to significant issues (recent defaults, etc.), also consider other steps: perhaps credit counseling, settling any outstanding debts, etc., in parallel with using a credit builder loan. Think of the credit builder loan as one tool in your toolbox. It’s especially effective if your issue is “no credit” or “thin credit.” If your issue is “damaged credit,” it’s still useful (because it shows you can now pay on time), but you’ll need patience and possibly additional credit repair strategies. Importantly, don’t borrow more than you can handle – if your finances are really tight, focus on stability first before taking on a credit builder loan commitment, because missing payments on it would just add another negative mark.

Q: After I finish a credit builder loan, what’s next?

A: Congratulations on building up some credit! Once your loan is done, review your credit score and report. Now that you’ve proven yourself with an installment loan, a great next step is often to get a credit card (if you haven’t already). You might now qualify for an unsecured credit card (store card or entry-level Visa/Mastercard) or you can opt for a secured credit card using the money you just got back. Using a credit card responsibly (small purchases paid off in full each month) will continue to build your credit, especially impacting your credit utilization and extending your credit history. Also, keep the older account (the loan) on your report – it will automatically stay for 10 years as a positive closed account, which is good for your credit age. Some people do multiple rounds of credit builder loans, but it’s usually not necessary to do it again unless you really want to build more savings and history. You could also explore other credit-building tools like Experian Boost® (which adds utility payments to your report) or getting a credit-builder credit card. Essentially, after the loan, use your improved credit to access mainstream financial products under better terms – that was the goal! Just continue the golden rule: pay everything on time, every time. Your shiny new credit score will thank you.

Disclaimer

This article is for informational purposes and is not financial advice. Individual results with credit builder loans can vary, and improving credit takes time and responsible financial behavior. Always review terms and conditions of any financial product before signing up, and consider consulting a certified financial counselor if you need personalized guidance. We strive to provide accurate, up-to-date information, but offers and policies may change – check with providers for the latest details. Neither the author nor the website guarantees any specific credit score improvements. Remember that building credit is a journey, and a credit builder loan is just one tool to help you along the way. Use it wisely!